Chargeback Management: 10 Tips to Reduce Revenue Loss

Chargeback management might seem like a daunting task, but it is an essential part of running an online business. Reducing revenue loss is key to protecting your bottom line.

Fortunately, we can help remove the complexities and streamline your processes so you retain more revenue with minimal effort. Check out these 10 introductory tips, simplified explanations, and detailed resources that can turn you into a chargeback master in no time.

1) Understand the chargeback process.

The process used to move a chargeback from initiation to resolution is fairly complex. There are detailed rules and confusing terms.

Even though it might be a struggle, you’ll want to make an effort at understanding the process. The more you know, the better you’ll be able to manage disputes and keep revenue loss to a minimum.

Here’s a basic overview.

The chargeback process is essentially a back-and-forth conversation between you and the cardholder. The conversation revolves around money: you expect the cardholder to pay for goods or services that were purchased, but the cardholder doesn’t want to.

Usually, the conversation is short. Someone’s argument doesn’t end up being compelling enough, so the discussion comes to a halt. Other times, the battle rages on and on.

The process can be broken down into five stages like this:

| PHASE | GENERAL SUMMARY OF WHAT HAPPENS |

| Chargeback | The cardholder is unhappy about a purchase that was made and demands the money be returned. |

| Chargeback Response | You object and try to persuade the cardholder to pay for what was purchased. |

| Pre-Arbitration | The cardholder changes the story but continues to dispute the purchase. |

| Pre-Arbitration Response | You refuse to take a financial hit and attempt to hold the cardholder responsible for payment one last time. |

| Arbitration | The cardholder remains adamant that payment isn’t due. The card brand (Mastercard®, Visa®, etc.) is asked to end the conversation by assigning responsibility once and for all. |

More details explaining the chargeback process, including a real-world example, can be found here. We suggest you analyze each phase of the process so you understand the options you have, the best action to take, and how to optimize revenue retention.

2) Use fraud detection tools.

Unfortunately, ecommerce businesses are commonly plagued by fraud. Because internet sales are so impersonal — there aren’t any face-to-face interactions — online businesses have become easy targets for criminal activity.

Unlike purchases made in brick-and-mortar stores, fraudsters don’t have to have access to a physical card to buy things online. All they need to do is steal a cardholder’s account information — and that’s pretty easy to do these days.

Once cardholders realize their account information has been compromised, they usually work quickly and diligently to get their money back. That means any business that processed an unauthorized transaction will likely receive a chargeback.

As an ecommerce business, you are susceptible to criminal fraud and the resulting chargebacks — unless you take the necessary steps to detect and block unauthorized transactions.

There are several tools available that can help you manage criminal fraud:

- Address Verification Service (AVS) – Address verification service compares the billing address provided during checkout to the address on file with the bank. In theory, the actual cardholder would know this personal information. Therefore, a mismatch indicates someone other than the cardholder is attempting to make a purchase.

- Card Verification Value (CVV) – A card verification value is printed on all credit and debit cards. If the shopper is unable to provide this three or four digit number during checkout, it could mean the person is using stolen information — rather than a card in hand — to initiate the transaction.

- 3D Secure 2.0 – 3D Secure 2.0 compares cardholder and transaction details that the business has with information the bank has. A mismatch — for example, an unusual device ID — could indicate someone other than the cardholder is using the card. 3DS2.0 is often referred to by brand-specific names such as Visa® Secure and Mastercard® SecureCode.

- Third-Party Vendors – The above-mentioned tools — AVS, CVV, and 3DS2.0 — are endorsed by the card brands (Mastercard, Visa, etc.) and probably accessible through your processor or gateway. In addition to those tools, there are also third-party vendors that provide identity verification and fraud detection services.

Using a combination of some or all of these tools can help you block unauthorized transactions, prevent chargebacks, and reduce unnecessary revenue loss. Which tools you use will depend on your business and its unique challenges.

Fraud tactics change and evolve, so it’s important to monitor the effectiveness of your chargeback prevention techniques over time. Your strategies and the tools you use will probably need to evolve too.

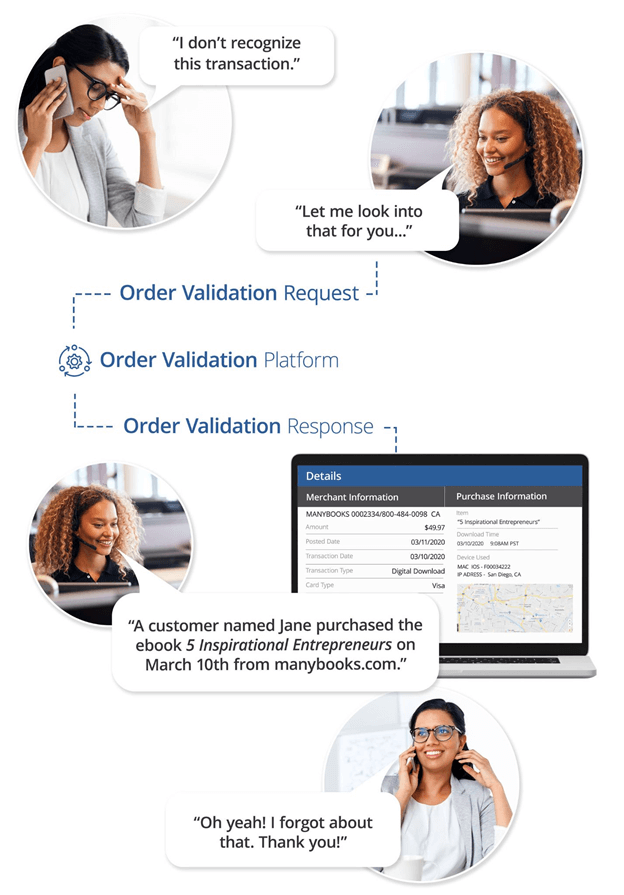

3) Check out order validation options.

Sometimes all it takes to prevent a chargeback is access to more information.

It’s not uncommon for a cardholder to attempt a dispute because of confusion. Maybe the cardholder forgot about a purchase or doesn’t recognize the business name associated with a charge.

In those situations, all the cardholder needs is a reminder or greater clarity. If the bank can give the cardholder needed insights, the issue would be resolved. But if the bank can’t provide any clarity, the case will likely escalate to a chargeback.

Fortunately, technology makes it possible to have those real-time moments of understanding.

There are two vendors that created order validation services: Ethoca™ and Verifi™. Through an integration with these platforms, you can share more than 140 different pieces of information with a cardholder’s bank in real time. The goal is to enable the clarity that’s needed to help the bank “talk off” the dispute. If the process is successful, you can prevent the chargeback and any loss of revenue.

To gain access to these order validation services, you’ll probably need to integrate through one of the vendors’ reseller partners (the vendors themselves don’t typically connect individual merchants).

4) Analyze your chargeback data.

Each chargeback you receive contains a wealth of valuable information. The following are some examples of insights you might gain from reviewing your chargeback data:

- Why the customer disputed the transaction

- Whether or not your fraud tools are working the way you want them to

- If order validation is providing enough clarity

- What your customer service team could do to improve the customer experience

- How accurate and effective your fulfillment team is

- Which countries have the highest risk of chargebacks

- How likely a particular piece of merchandise or an individual service is to cause a chargeback

- What the ideal price point is to optimize profitability

- How long customers perceive value in your subscription

- Which marketing tactics are attracting high-risk customers

- What the chargeback-to-transaction ratio is for each cardholder bank

Analyzing your chargeback data is a great way to reduce revenue loss. Here’s what you need to do:

- Locate your data. Information is probably stored in a variety of different platforms including your processor’s online portal, your payment gateway ( CyberSource, USAepay, Authorize.net, eMerchantGateway), your order management system, and your customer service software.

- Consolidate all the available information associated with your chargebacks into one place.

- Break down the data by different variables such as the marketing source that triggered the original transaction, the AVS response code sent during authorization, the items purchased with the disputed transaction, etc. The more granular your analysis, the greater the insights.

- Chart your data. Make it easy to review trends, sort the information, and take a deep dive into your chargeback activity.

- Establish the norms for your business. Which reason code do you receive most often? Which country has the highest chargeback-to-transaction ratio? Determine what the normal threshold is for each variable.

- Monitor your chargeback trends and look for anomalies. Any time you see something that differs from the norm, analyze it. Discrepancies usually indicate there is an underlying issue you are unaware of.

- Solve problems at their source. Don’t look for quick fixes that only offer temporary solutions. Dig in and discover what’s really happening.

Without data, your chargeback management strategy will be based on hunches, guesses, and assumptions. But with data, you’ll make educated decisions that yield sustainable results.

5) Encourage your customer service team.

When your customers have problems with their purchase, they’ll do one of two things. They’ll either reach out to you to resolve the issue. Or, they’ll go straight to the bank for a chargeback.

Obviously, you prefer that customers give you the opportunity to make things right. But how can you ensure that happens? What would tip the scales in your favor?

You need to do all you can to create an exemplary customer experience from beginning to end. The best scenario would be these three things happening without a hitch:

- The customer recognizes that you would be easy to work with.

- You collaborate with the customer when there is a problem and identify a satisfying solution.

- You follow through on what you’ve promised.

Some examples on how to improve your customer service experience with the specific goal of preventing chargebacks include:

- Proactively reaching out after a sale to gauge satisfaction

- Being friendly and accommodating

- Admitting to mistakes and accepting responsibility

- Equipping the customer service team with the insights and authority needed to resolve issues

- Enabling customers to resolve issues themselves through self-service platforms like live chat, apps, or voice-response phone systems

- Engaging in social media conversations

- Promptly responding to phone calls and emails

6) Review your policies for returns, refunds, and exchanges.

In its most basic sense, the purpose of any chargeback is to return money to a cardholder. So to avoid chargebacks, there needs to be an alternate process for achieving the same result.

That’s where your policies for returns, refunds, and exchanges come into play. Your refund process needs to be easier, quicker, and more satisfying than the bank’s chargeback process.

Focus on creating customer-centric policies. What can you do to encourage refunds or exchanges instead of chargebacks? This article lists 13 suggestions specifically designed to create policies that minimizes the risk of chargebacks. The following are a few examples:

- Write easy-to-understand policies.

- Make your policies easy to find.

- Extend the refund time limit.

- Offer free return shipping.

- Be courteous.

- Clearly outline your expectations.

- Include frequently asked questions and their answers.

- Share customer testimonials.

Technically, a refund still causes you to lose revenue. However, a refund doesn’t have nearly as many consequences as a chargeback. Among other things, you’ll avoid the chargeback fee — which means more of your money stays with you where it belongs.

7) Audit your fulfilment team.

When it comes to chargebacks, you might unfortunately be your own worst enemy. It’s common for disputes to be caused by innocent mistakes, errors, or shortcomings. While this might be hard to hear, there is good news.

Overcoming merchant errors is an easy chargeback management fix. Once you’ve identified the problem and solved it, the chargebacks should stop.

When you are ready to start auditing your teams and processes, start with the fulfillment department. There might be quick and easy fixes that will make a big difference to your chargeback management efforts. Here are a few things to check:

- Make sure merchandise is shipped in the correct sized box and with sufficient packing material. If items are broken during transit, chargebacks are warranted.

- Schedule routine training sessions to explain any new or updated merchandise. Your team needs to be familiar with what is being sold so the correct items are sent.

- Check how long it takes to fulfil and deliver orders. Are packages reaching customers within the promised time frame?

8) Understand ‘friendly’ fraud.

Chargebacks were originally invented to protect consumers from fraud. But over time, consumers have identified loopholes in the process and have started to use chargebacks incorrectly.

This incorrect use of the chargeback process is often referred to as ‘friendly’ fraud. The name friendly fraud is derived from the concept of friendly fire — which is an attack from someone that can usually be trusted. In the world of ecommerce, that unsuspected attack comes from your own customers when they initiate invalid chargebacks that never should have happened.

The following are some examples of friendly fraud:

- Rebecca ordered a red dress but later decided she wanted something black. Rather than contact the merchant and exchange the dress for something else, she filed a chargeback by falsely claiming the wrong merchandise was shipped.

- Jack forgot to cancel his membership before the free trial ended. When his account was charged, Jack called the bank instead of the gym.

- Kate didn’t recognize a charge to her account and couldn’t remember buying anything. Rather than investigate the purchase, she clicked “dispute charge” in her online banking portal and indicated the transaction was probably fraud.

It is essential to understand friendly fraud — what these chargebacks are, why they happen, and how to handle them. Here are a few things to note:

- Friendly fraud is different from criminal fraud. It might seem like “fraud is fraud,” but the two threats have their own unique management techniques.

- It’s difficult to prevent friendly fraud. Great customer service, a clear billing descriptor, and order validation services are usually the best (and only) way to avoid these disputes.

- Friendly fraud is a growing threat. More and more consumers are turning to these illegitimate disputes as a way to solve problems.

- You can — and should — fight friendly fraud. You have the right to challenge invalid disputes and recover revenue that has been unfairly sacrificed.

9) Respond to invalid chargebacks.

Chargeback management consists of two parts: preventing chargebacks and fighting chargebacks.

The first eight steps in this article focused mainly on preventing chargebacks. Those suggestions can do a lot to reduce risk. However, it’s impossible to completely eliminate all chargebacks. So when chargebacks do happen, you need to know how to respond.

If a chargeback is invalid, you can and should fight back to recover lost revenue. There are dozens of things you should know as you build a chargeback response strategy. Here are a few of the most important pieces of information:

- When you fight a chargeback, you are asking for money to be revoked from the cardholder and returned to you. That’s a big and serious request! The bank won’t act simply because you asked. Rather, you have to convince the bank that the chargeback is invalid by presenting a persuasive argument backed with solid proof. That proof is called compelling evidence. Acceptable forms of evidence are generally any documents that can help contradict the claims that were made with the chargeback. Examples might include email conversations with the customer, delivery tracking information, signed contracts, etc.

- All chargebacks are classified with reason codes. The assigned reason code regulates many things including what types of compelling evidence you need to include in your chargeback response.

- Chargeback response packages should include a concise, professional rebuttal letter that gives an overview of the included compelling evidence.

- Responses must be submitted within a set time frame, and deadlines are firm. There aren’t any extensions or exceptions. If you don’t submit your chargeback response before the deadline, it won’t be accepted and there is no chance of winning.

- After you submit a chargeback response, the cardholder’s bank will review it and decide who is liable (you or the cardholder). If the bank finds in the cardholder’s favor, you lose the case and the cardholder keeps the money. If the bank finds in your favor, you win and the disputed funds are returned to your bank account.

- A metric commonly used to evaluate chargeback management performance is win rates. Win rates are typically expressed as a percentage and calculated by dividing the number of chargebacks that were won by the number of chargebacks that were fought.

- When you fight, you should consider the return on investment (ROI). Chargeback management ROI compares the amount you spend on fighting against what you are able to recover. If your efforts are expensive or your strategy is not effective, you could have a negative ROI. In these situations, you’ll want to find ways to cut costs, improve your win rate, or both!

10) Use a chargeback management platform.

Chargeback management can be a difficult task if you try to do it all on your own. Fortunately, there are services available that can help simplify the process. Not only do these services specialize in reducing revenue loss, but they should also be able to help you manage chargebacks with fewer costs and higher ROI.

There are a few service providers available, so be sure to carefully consider each option. As you shop around, look for a service provider with these features:

- Multiple services in a single platform – Choose a comprehensive technology platform that can help you prevent and fight chargebacks. You want to be able to manage everything in one place.

- Real-time reporting and analytics – One of the most difficult components of a chargeback management strategy is achieving transparency. With data stored in multiple different platforms, it is hard to understand what is really happening. Make sure your service provider can consolidate all your information in real time and make it easy to analyze. Reports should be created for each service provided.

- Multiple high-achieving KPIs – Results might seem more impressive than they are if taken out of context. For example, a company might boast of a high win rate. But a high win rate is only impressive if the company is fighting a significant portion of disputes with a high ROI.

- Technology-driven approach – The more technology used, the better your results will be. Manual processes are time-consuming, labor-intensive, and error-prone. Service providers that avoid automation won’t be able to achieve the same cost-effective, high-performing results as a company that has a tech-oriented approach.

- A respected, honest team of professionals – Look beyond a company’s sales pitch, and really get to know who you’d be working with. Partner with a company that is respected throughout the industry and has a reputation of integrity.

Tired of Losing Money to Chargebacks?

Don’t let chargebacks steal any more of your hard-earned money. Create a chargeback management strategy today and start reducing your risk. The sooner you address the situation, the sooner you’ll boost your bottom line!

About the author:

Jessica Velasco is a chargeback education specialist at Midigator®. Midigator uses technology to prevent, fight, and analyze chargebacks, providing an efficient and effective alternative to time-consuming, manual processes. Features like real-time reporting, labor-saving automation, and in-depth analytics benefit businesses of all sizes in all industries. To learn more, visit Midigator.com or follow the team on LinkedIn, Facebook, and Twitter.

.